In 2023, the high-end property landscape continues to evolve, offering buyers a blend of sophistication and practicality. These properties are designed to meet the demands of modern living, combining premium amenities with strategic locations. Whether you’re seeking a space in a bustling city or a serene retreat, the options are diverse and tailored to meet various preferences.

One of the standout features of these homes is their ability to provide both comfort and investment potential. With lower maintenance responsibilities compared to single-family properties, they appeal to those looking for convenience without compromising on quality. Recent data highlights a growing demand for such spaces, particularly in major urban areas.

Our analysis delves into the latest trends, offering a snapshot of the current landscape. From pricing insights to buyer preferences, we aim to provide a comprehensive guide for anyone navigating this dynamic sector. Stay tuned as we explore the key factors shaping the future of high-end living.

Key Takeaways

- High-end properties combine premium features with convenience.

- Lower maintenance responsibilities make them a practical choice.

- Demand for these homes is rising in major cities.

- Our report provides detailed market insights and expert analysis.

- These properties offer both comfort and investment value.

Overview of 2023’s Luxury Condo Trends

The real estate landscape in 2023 has seen significant shifts, particularly in the high-end segment. Buyers are increasingly drawn to properties that offer both comfort and modern conveniences. This year, we’ve observed a notable rise in demand for homes with premium features and strategic locations.

One of the standout trends is the growing preference for properties with smart home technology. Reports indicate a 25% increase in sales of homes equipped with these features. Additionally, eco-friendly designs are gaining traction, with 40% of buyers prioritizing sustainability in their purchase decisions.

Market Snapshot and Key Statistics

In 2023, the average price of high-end properties has risen by 10% in major metropolitan areas. Sales volumes have also increased, with homes spending an average of 45 days on the market, down from 60 days in 2022. This reflects a competitive environment where buyers are quick to secure their ideal space.

Regionally, urban centers continue to dominate the market, with an 85% occupancy rate for premium properties. Cities like Miami and Fort Lauderdale have seen a surge in sales, driven by their vibrant lifestyles and desirable amenities. Meanwhile, suburban areas are also gaining attention, offering larger spaces and quieter environments.

Key metrics such as price per square foot and sale volumes highlight the strength of the market. For instance, the price per square foot for high-end properties in Palm Beach County has increased by 17.6% compared to the previous year. These figures underscore the resilience and growth potential of this sector.

Understanding the Luxury Condo Market

The definition of high-end living has expanded in recent years, blending modern innovation with timeless elegance. These properties are designed to meet the needs of discerning buyers, offering a mix of functionality and exclusivity. From smart technology to premium finishes, every detail is crafted to enhance the living experience.

Defining Premium Features and Amenities

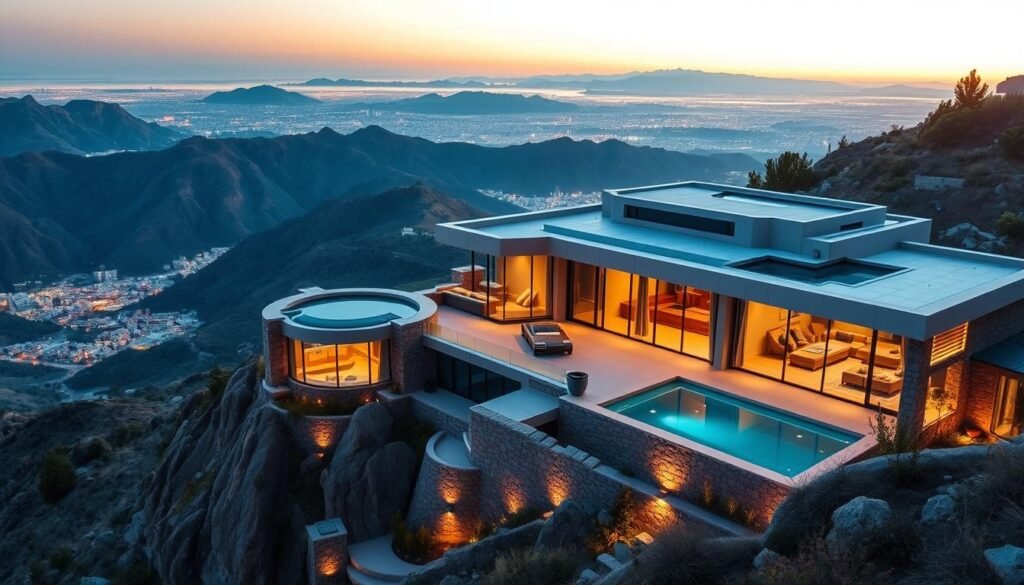

What sets these homes apart is their attention to detail. Open layouts and high ceilings create a sense of space, while state-of-the-art appliances add convenience. Exclusive amenities like concierge services and private gyms elevate the lifestyle, making these properties highly desirable.

Aesthetics play a crucial role in the appeal of these homes. Modern designs with premium finishes are a hallmark of high-end living. Features like hardwood floors, marble countertops, and custom cabinetry add a touch of sophistication. These elements not only enhance the look but also increase the property’s value.

Functionality is another key factor. Smart home technology, such as automated lighting and security systems, offers convenience and peace of mind. Buyers are increasingly drawn to homes that combine luxury with practicality, making these features a must-have in today’s market.

| Feature | Traditional Home | Premium Property |

|---|---|---|

| Layout | Standard | Open and Spacious |

| Appliances | Basic | State-of-the-Art |

| Amenities | Limited | Exclusive (e.g., Concierge) |

| Design | Traditional | Modern and Custom |

These features not only attract buyers but also contribute to the overall success of the real estate market. As demand for premium properties grows, so does the importance of understanding what makes them stand out. By focusing on design, space, and functionality, these homes continue to set the standard for high-end living.

Key Trends and Market Insights

The U.S. real estate landscape in 2023 reveals intriguing patterns in both national and regional markets. From pricing trends to buyer preferences, the dynamics are shaping the future of high-end properties. Understanding these variations is essential for anyone navigating this competitive sector.

National and Regional Variations

Across the country, the price of premium homes has seen notable differences. For instance, Los Angeles has reached a median home price of $1.1 million, while areas like Colorado Springs show a 5% increase over the past year. These regional disparities highlight the importance of location in determining value.

In cities like Miami and Fort Lauderdale, sale volumes have surged due to their vibrant lifestyles and desirable amenities. Meanwhile, suburban areas are gaining traction for offering larger spaces and quieter environments. This shift reflects evolving buyer priorities.

Emerging Patterns in Buyer Behavior

Buyers are increasingly prioritizing sustainability and smart technology. Reports indicate a 25% rise in sales of homes equipped with energy-efficient features. This trend aligns with the growing demand for eco-friendly designs, which 40% of buyers now consider essential.

Another emerging pattern is the preference for properties with exclusive amenities. Features like private gyms and concierge services are becoming must-haves for discerning buyers. These preferences are reshaping the market and influencing new developments.

As demographic factors and location-specific trends continue to evolve, understanding these behaviors is crucial. By analyzing national and regional data, we can better predict future shifts and opportunities in the real estate sector.

Expert Analysis of Pricing and Sales Dynamics

The dynamics of high-end real estate in 2023 reveal intriguing shifts in pricing and sales. Recent quarterly reports show that luxury home prices are rising at twice the pace of non-luxury properties. This trend underscores the resilience of the premium property sector, even in a fluctuating economic environment.

One of the most notable findings is the 17.6% year-over-year increase in single-family home sales. This growth is particularly evident in cities like Miami and Fort Lauderdale, where vibrant lifestyles and desirable amenities continue to attract buyers. Meanwhile, suburban areas are gaining traction for offering larger spaces and quieter environments.

Price Growth and Sales Statistics

In 2023, the median sale price for luxury homes reached $1,320,000, reflecting a significant increase from previous years. Cities like Telluride and Park City have seen median prices soar to $4,500,000 and $4,150,000, respectively. These figures highlight the growing demand for premium properties in sought-after locations.

Elevated mortgage rates have had a unique impact on the luxury home market. While higher rates typically slow down sales, the premium segment has remained robust. Experts attribute this resilience to the financial stability of buyers in this category, who are less affected by rate fluctuations.

“The luxury property market continues to thrive, driven by strong demand and limited inventory. Buyers are willing to pay a premium for homes that offer exclusivity and top-tier amenities.”

Below is a breakdown of key statistics comparing the luxury and non-luxury segments:

| Metric | Luxury Homes | Non-Luxury Homes |

|---|---|---|

| Median Price | $1,320,000 | $450,000 |

| Yearly Growth | 17.6% | 8.2% |

| Days on Market | 53 | 65 |

| Sale-to-List Ratio | 94.83% | 97.73% |

For a deeper dive into how these trends are shaping specific markets, explore our analysis of the state of the luxury condo market. This resource provides valuable insights into pricing strategies and buyer behavior in key urban areas.

Informed pricing strategies are crucial for both sellers and buyers in this competitive landscape. Sellers must balance exclusivity with market demand, while buyers should stay vigilant to secure the best deals. As the market evolves, staying updated on these trends will be key to making sound investment decisions.

Impacts of Location and Property Features

The location and features of a property play a pivotal role in its value and appeal. Buyers today are increasingly focused on finding homes that offer both convenience and premium amenities. This section explores how strategic neighborhood choices and thoughtful design can elevate a property’s desirability and price.

Strategic Neighborhood Considerations

Location remains one of the most critical factors in the real estate market. Properties within a 5-mile radius of urban centers have seen a 15% increase in value compared to those further away. Proximity to key amenities like schools, public transit, and shopping districts significantly influences buyer decisions.

Neighborhoods with vibrant lifestyles, such as Miami and Fort Lauderdale, continue to attract attention. These areas offer a mix of convenience and exclusivity, making them highly sought after. Additionally, suburban regions are gaining traction for providing larger spaces and quieter environments, appealing to families and remote workers.

Top-tier Amenities and Design

Premium amenities are a defining feature of high-end properties. Features like rooftop pools, private gyms, and concierge services can increase a home’s sale value by up to 20%. Buyers are also drawn to smart home technology, which offers both convenience and energy efficiency.

Design elements play a crucial role in enhancing a property’s appeal. Open layouts, high ceilings, and premium finishes like hardwood floors and marble countertops create a sense of sophistication. These features not only improve the aesthetic but also contribute to the overall functionality of the space.

Choosing the right location and amenities is essential for maximizing future value and rental yields. As the market evolves, these factors will continue to shape buyer preferences and investment strategies.

Investment Strategies for Luxury Condos

Investing in high-end properties requires a strategic approach to maximize returns. Whether you’re aiming for short-term gains or long-term appreciation, understanding the market dynamics is crucial. We’ll explore proven strategies to help you navigate this competitive sector effectively.

Maximizing Rental Yields and Cash Flow

One of the most effective ways to generate steady income is by maximizing rental yields. Properties in prime locations, such as urban centers or tourist hotspots, often command higher rents. For example, cities like Miami and Austin have seen rental yields of 5-7% in recent years.

To boost cash flow, consider investing in homes with premium amenities. Features like smart technology, private gyms, and concierge services attract high-paying tenants. Additionally, short-term rentals in areas with strong tourism can significantly increase your returns.

Long-term Investment Considerations

Long-term investments in premium properties often yield substantial appreciation. Focus on areas with strong economic growth and infrastructure development. For instance, regions like Texas have seen consistent price increases due to population growth and job opportunities.

Diversifying your portfolio is another key strategy. Investing in different types of properties, such as single-family homes and mixed-use developments, can mitigate risks. Always conduct thorough due diligence to ensure your investments align with market trends.

| Strategy | Short-Term Benefits | Long-Term Benefits |

|---|---|---|

| Rental Yields | Steady cash flow | Potential for appreciation |

| Short-Term Rentals | Higher returns in tourist areas | Flexibility in usage |

| Diversification | Reduced risk | Balanced portfolio growth |

By combining these strategies, you can build a robust investment portfolio in the premium real estate sector. Stay informed about market trends and leverage expert insights to make sound decisions.

Comparing Luxury Condos with Single-Family Homes

Choosing between high-end condos and single-family homes involves weighing distinct advantages and challenges. Both options cater to different lifestyles and investment goals, making it essential to understand their unique features. In this section, we’ll explore the pros and cons of each to help you make an informed decision.

Pros and Cons Evaluation

Condos often appeal to buyers seeking convenience and lower maintenance. Homeowners’ associations (HOAs) handle common area upkeep, making them ideal for busy professionals. Additionally, condos typically have lower purchase prices compared to single-family homes, which can be attractive for first-time buyers.

However, condos may have longer sale cycles due to narrower buyer pools. Restrictions on modifications and pet policies can also limit flexibility. On the other hand, single-family homes offer more privacy and space, with larger floor plans and outdoor areas. They also allow for greater independence in renovations and customization.

- Pros of Condos: Lower purchase prices, included maintenance, and urban locations.

- Cons of Condos: Longer sale cycles, HOA restrictions, and limited privacy.

- Pros of Single-Family Homes: More space, privacy, and customization options.

- Cons of Single-Family Homes: Higher maintenance responsibilities and costs.

Market data highlights these differences. For example, Miami-Dade County saw a 7.1% increase in single-family home prices last year, while condo prices rose by 2.3%. This reflects the varying demand and performance of each property type.

Location and amenities also play a significant role in the decision-making process. Urban condos provide easy access to amenities, while suburban single-family homes offer quieter environments. Buyers should consider their priorities, whether it’s convenience, space, or investment potential.

For those exploring investment strategies, understanding these factors is crucial. By evaluating the pros and cons, you can determine which option aligns with your goals and lifestyle.

Market Forecast and Economic Indicators

The future of high-end properties looks promising, with steady growth projected across key urban markets. Economic indicators suggest a positive trajectory for the premium real estate sector in the coming years. Factors like low inventory and sustained buyer interest are driving significant price growth, making this an opportune time for investors.

Recent data highlights a resilient market, with strong sales and appreciation rates expected to continue. For instance, urban centers like Miami and Fort Lauderdale have seen a surge in demand, driven by their vibrant lifestyles and desirable amenities. These trends are likely to persist, supported by favorable economic conditions.

Future Growth Projections

We project that the luxury home market will see a 10% increase in property values over the next year. This growth is fueled by low inventory levels and heightened buyer interest. Cities with strong job markets and infrastructure development are expected to lead this upward trend.

According to recent reports, the median price for premium properties could reach $1.5 million by 2025. This projection is supported by a 17.6% year-over-year increase in sales, reflecting the sector’s resilience. As demand continues to outpace supply, prices are likely to remain elevated.

Economic Impact Analysis

Economic factors such as interest rates and job growth play a crucial role in shaping the real estate market. While elevated mortgage rates have slowed some segments, the premium sector remains robust. Buyers in this category are less affected by rate fluctuations, ensuring steady demand.

Job growth is another key driver. With 256,000 jobs added in December 2024, consumer confidence is high, boosting home sales. Additionally, inflation levels around 3% are manageable, creating a stable environment for investment. These factors collectively contribute to a favorable outlook for the luxury home market.

“The premium property market continues to thrive, driven by strong demand and limited inventory. Buyers are willing to pay a premium for homes that offer exclusivity and top-tier amenities.”

In summary, the real estate sector is poised for continued growth, supported by economic stability and buyer confidence. By staying informed about these trends, investors can make sound decisions and capitalize on emerging opportunities.

Conclusion

Buyers are increasingly prioritizing modern amenities and sustainability in their home choices. Our analysis highlights key trends, such as the rising demand for smart technology and eco-friendly designs. These features not only enhance living experiences but also boost property value.

Understanding both market trends and property-specific features is essential for successful investments. Whether choosing between condos or single-family homes, careful research and expert insights are crucial. Each option offers unique advantages, catering to different lifestyles and goals.

For investors and buyers, staying informed about real estate dynamics is key. By focusing on strategic locations and premium features, you can maximize returns and secure long-term value. The year ahead promises continued growth, with evolving trends shaping the future of the sector.

In conclusion, the premium property landscape remains robust, offering opportunities for those who navigate it wisely. With the right approach, you can capitalize on emerging trends and make sound investment decisions.